Simplicity Digital Advisor

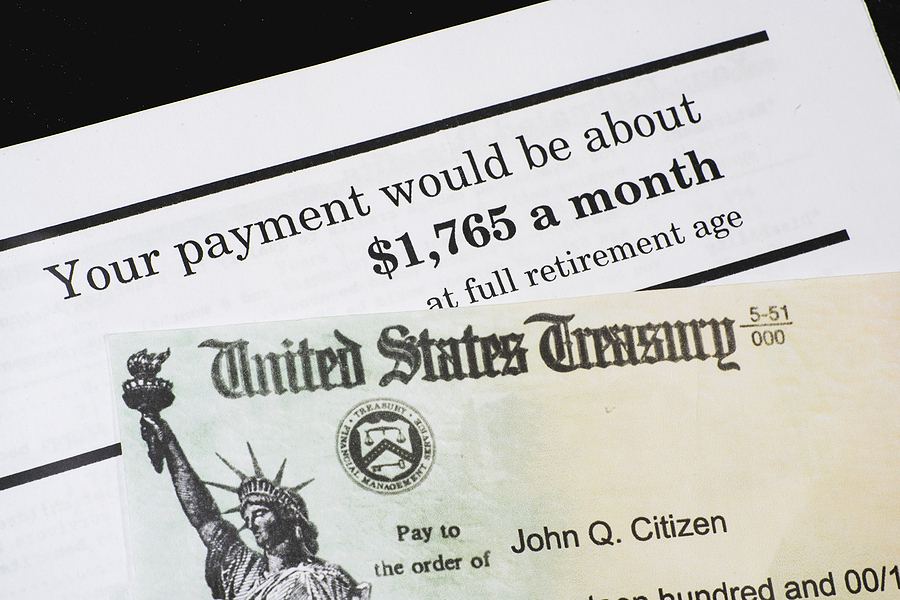

Social Security COLA May Be Less in 2024

For 2023, Social Security Retirement and Supplemental Security Income (SSI) benefits increased due to inflation. The increase was 8.7%, resulting in an average monthly benefit increase of $146 per month for a yearly increase of $1,827 in 2023.

6 Tips to Help You Save on Summer Travel

If you love to travel, summer is a great time to do so and have new experiences near home or far away. As you plan, remember to budget for travel expenses and look for ways to save during the peak summer travel season.

National Financial Freedom Day: 10 Tips to Work Toward Financial Freedom

National Financial Freedom Day is observed each year on July 1ST. This holiday raises awareness about financial freedom and how it may improve your financial stability. Financial freedom is controlling one’s finances, covering expenses, and saving for future goals.

Insurance Awareness Day: Time to Assess Your Risk

Insurance Awareness Day, recognized on June 28th, is a great time to review your insurance coverage and assess your risk. Insurance is a means of protecting your assets against premature liquidation and protecting yourself and your loved ones.

Smart Ways to Prepare for Next Year’s Taxes

The financial decisions you make between now and the end of the year can significantly impact how much taxes you will have to pay once tax day arrives. There are things you can do now to help prepare for next year’s taxes.

Strategies to Help Your Kids Save for Retirement

Helping your kids save for retirement starts with financial education and discussing the importance of saving for their future. But, besides financial education, there are strategies that you can implement for them at a young age. The strategies can help them get a head start on their retirement savings.

What to Know About Today’s Credit Card Interest Rates

Credit cards may make it easy to cover a variety of expenses. Credit card use often helps increase one’s credit score if the balances are paid in full each month and on time. However, mismanaging credit or carrying balances over time can lower credit scores. It may be a risk to your financial future since lenders use credit scores to

What Rising Gas Prices Mean For Consumers and the Economy

Rising gas prices can impact consumers and the economy in many ways. For example, rising gas prices affect consumers at many places they purchase goods. If the places rely on gas, natural gas, or crude oil:

Life Insurance: Essential to Financial Planning

Now is a great time to review your life insurance policies and determine if you have enough coverage. Learn more about how life insurance is essential to financial planning. When someone we know passes, often, we are reminded how precious life is and how financial stability can rapidly change. In some instances, they did not have enough life insurance coverage.

Understanding the DROPs Government Employee Retirement Program

Government employees, such as teachers, firefighters, police, and others, often consider working after their eligible retirement age. Especially when presented with a deferred retirement option plan (DROPs) offer.